Blog

Blog

Dual Pricing: How it can Benefit Your Business

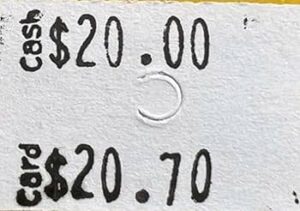

Dual pricing is the practice of displaying both a cash/debit price and a credit card price for a product or service at the point of sale. As a merchant, dual pricing can be used as a benefit by offering customers a discount for using a preferred payment method, such as cash or debit. By doing so, merchants can incentivize customers to choose that method of payment and avoid the cost of processing credit card transactions. This can be particularly beneficial for small businesses with limited profit margins.

In addition to reducing the cost of processing credit card transactions, dual pricing can also encourage customers to use payment methods that are more secure or easier to process. For example, merchants may offer a discount for using a contactless payment method, such as Apple Pay or Google Wallet, or for using debit cards, which are more secure and easier to process than traditional credit cards.

It’s important to comply with regulations and guidelines governing surcharging when implementing dual pricing. In the United States, surcharging is subject to state laws and regulations, as well as card network rules. Merchants should consult with their payment processor and legal advisors to ensure compliance with these regulations and guidelines.

Overall, dual pricing can be a beneficial strategy for merchants to reduce the cost of processing credit card transactions and incentivize customers to use preferred payment methods. However, it’s essential to implement the practice in a transparent and compliant manner to avoid any negative impact on the customer experience.